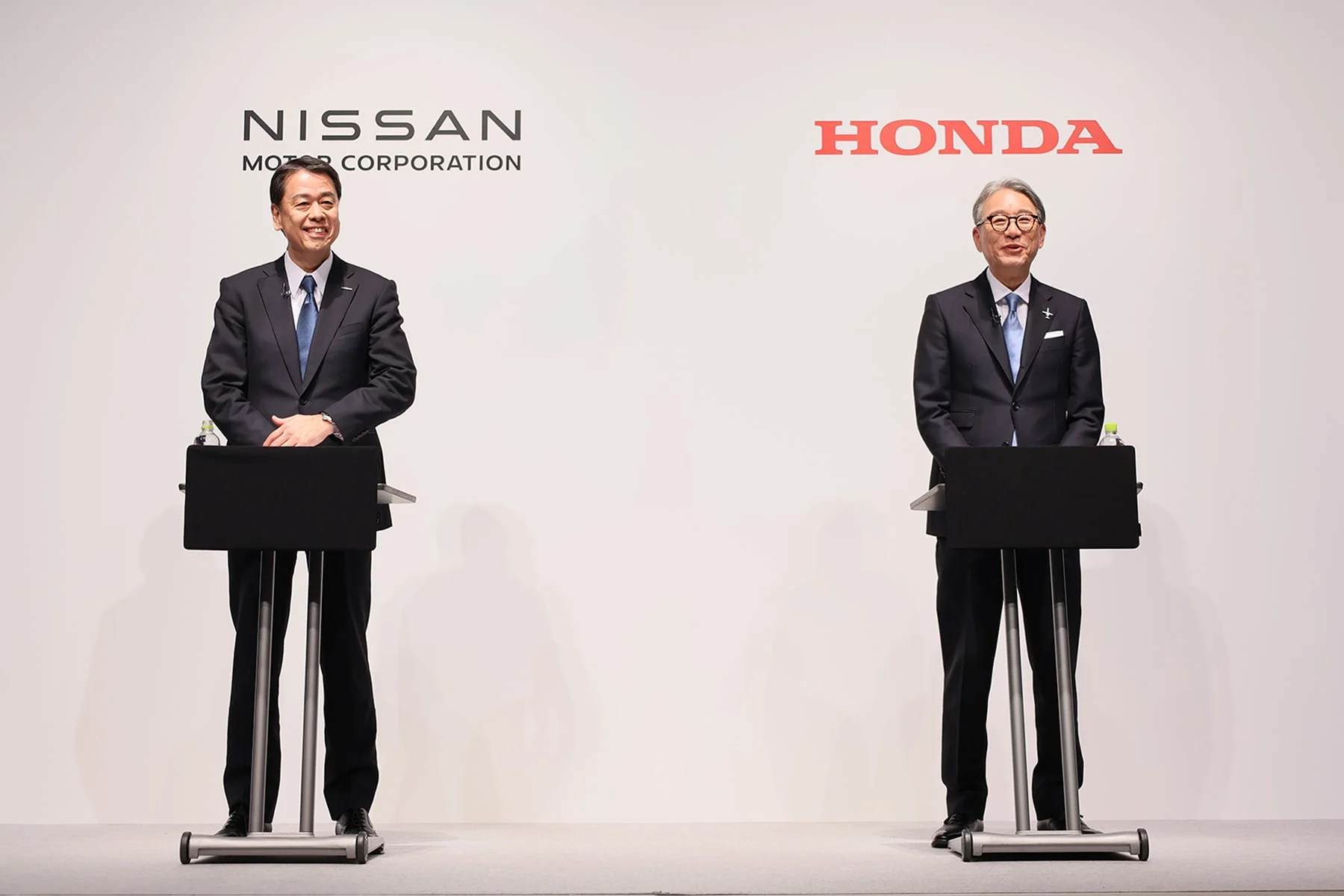

The suggested $60 billion Nissan Honda merger has been put on hold officially, leaving Nissan in a weak position in the face of increased competition from Chinese electric vehicle (EV) producers and possible U.S. tariffs. The negotiations that started last December collapsed over issues, with Honda allegedly insisting that Nissan be turned into a subsidiary—a point of contention that ultimately killed the deal.

If the merger had taken place, it would have formed the world’s fourth-largest car group, behind only Toyota, Volkswagen, and Hyundai. But both carmakers have agreed to maintain their current technology-sharing partnership, which also involves Mitsubishi Motors.

Honda CEO Toshihiro Mibe spoke about the collapse of the talks, noting that although a tie-up would have brought temporary relief, repeated delays were considered too risky. He also ruled out any plans to take over Nissan by force, though he was disappointed at the outcome of the talks.

For Nissan, the inability to seal the merger amplifies its current woes. The automaker is still reeling from the backlash of the 2018 ouster of former chairman Carlos Ghosn and is still struggling through a restructuring plan. Nissan also announced additional cost-cutting efforts, including shuttering a factory in Thailand by June and two other undisclosed locations. This follows a previous move to slash 9,000 jobs and cut global production capacity by 20%.

Nissan Honda merger dream ends before coming true, Nissan seeks new partnerships

Nissan CEO Makoto Uchida emphasized the need to finish the turnaround of the company, suggesting that he might resign once the company is on solid ground. He also confirmed that Nissan is willing to consider new partnerships, with Taiwan’s Foxconn—famous for its EV plans—surfacing as a possible partner. But Uchida dismissed that there were official talks at the executive level.

Industry experts are still doubtful about the long-term effect of Nissan’s current alliances. Tang Jin, a senior analyst at Mizuho Bank, noted that alliances by themselves will not be able to protect Nissan and Honda from aggressive rivals such as Tesla and BYD.

With Nissan’s market capitalization now well behind Honda’s, the failure of the merger underlines the gap widening between the two Japanese carmakers. Investors have scaled back initial enthusiasm since the announcement of the deal, with both firms standing at a crossroads in an accelerating changing car industry.

Also, see:

Saudi Arabia’s Digital Transformation: Global Ranking in Digital Services Revealed